Message from the Officer in Charge of Finance

Toward the realization of management that is conscious of cost of capital and share price

General Manager of Finance & Accounting Department

Toshiki Kume

Reflection on cash allocation under the Previous Medium-Term Management Plan [SG-2023]

Our previous Medium-term management plan SG-2023 (“SG-2023”) drew to a close on March 31 this year. To reflect on the financial results of the fiscal year ended March 31, 2024, the final year of the plan, although net sales achieved the plan’s initial target, operating profit fell short, which meant that we did not reach our targets for return on equity (ROE) or return on invested capital (ROIC). The first half of SG-2023 coincided precisely with the COVID-19 pandemic, which was a period of considerable hardship for all companies. The ShinMaywa Group also felt the impact of the pandemic, both directly and indirectly, but we were fortunate in that we have many businesses that are related to social infrastructure, and we managed to come through without a major drop in sales. In the final year of the plan, however, the soaring costs of materials, particularly in the Special Purpose Truck and Parking Systems segments, and major increases in management costs, primarily labor costs, had an impact, and while we did raise some prices, it did not lead to sufficient improvement in profitability.

Regarding our growth investments, we welcomed five new companies to the Group through M&As in the Special Purpose Truck, Aircraft, and Fluid segments, and we also made capital investments totaling 15.9 billion yen for the purposes of increasing production and improving quality and operational efficiency. However, the operating cashflow used to fund these investments fell short of the planned figure, and this, combined with revisions and delays in some of our investment plans, meant that total growth investments did not reach our initial target level.

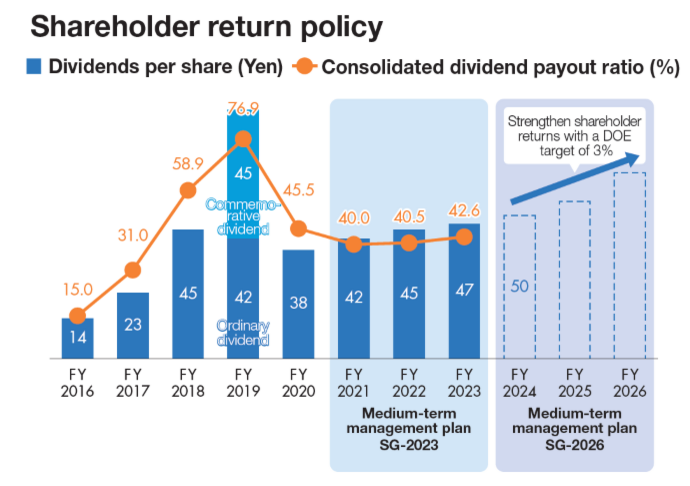

Dividends were paid within the payout ratio range indicated for each fiscal year, and we increased the dividend every year for three consecutive years from the fiscal year ended March 31, 2021.

| SG-2023 Target standard | FY2023 Results | |

|---|---|---|

| Net Sales | 250 billion yen | 257.0 billion yen |

| Overseas sales(included in above) | 45 billion yen | 53.2 billion yen |

| Operating Profit | 15 billion yen | 11.7 billion yen |

| ROE | 10% or more | 7.1% |

| ROIC | 7% or more | 5.3% |

| Growth investment (capital investment, M&A) | 30-40 billion yen (total for three years) | 22.1 billion yen (total for three years) |

| Dividend payout ratio | 40~50% | 42.6% |

| Equity ratio | 40% or more | 41.1% |

Cash allocation under the new plan SG-2026

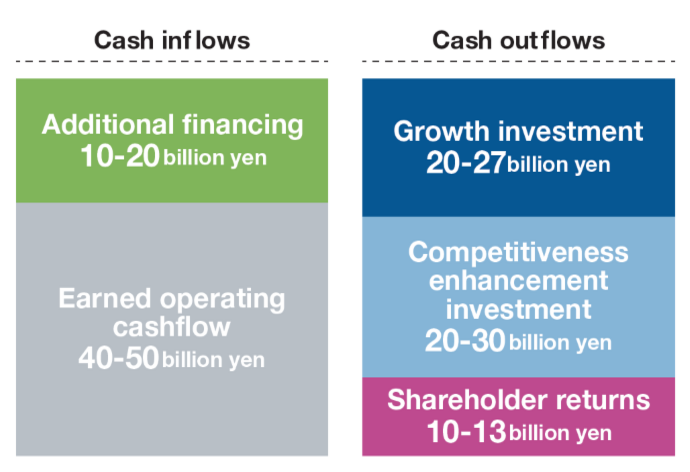

In the new Medium-term management plan SG-2026 (“SG-2026”), which started in April, we have made new cash allocations based on the outcomes and our reflection of SG-2023.

| SG-2026 Target | |

|---|---|

| Growth and competitiveness enhancement investments (capital investment, M&A, other) (capital investment, M&A, etc.) |

40-57 billion yen (total for three years) |

| Dividend on equity ratio (DOE) | Conduct dividends of around 3% |

To achieve our Long-term vision for 2030, namely, to become a corporate group with net sales of 400 billion yen, it is essential that we invest in a planned, strategic manner, and that we reap the outcomes of those investments at an early stage. As investment targets, we will focus our efforts on identifying and realizing the M&A projects that are currently being considered, so that we can quickly gain a sense of brand recognition and expansion of business partners in the global market. In addition, bearing in mind that there are inherent risks of new threats even in our existing businesses that enjoy high market shares, we will use DX and new technologies and services to respond to the changes in our customers’ environments and preferences. Moreover, from among the new businesses for which we planted seeds during the SG-2023 plan period, we will also actively invest in those projects that aim for early profitability.

In the new plan, we have adopted dividend on equity ratio (DOE) as a new indicator for shareholders. In previous plans up to SG-2023, we had indicated a range for dividend payout ratio. However, because net profit, which is used as the denominator in calculating that ratio, fluctuates significantly from fiscal year to fiscal year, it is difficult to ascertain the status of qualitative returns. For this reason, in SG-2026, in our aim of stable, continuous dividend increases, we have decided to indicate DOE, which has shareholders equity as the denominator.

Conduct management that is rated highly by the market to achieve a price-to-book ratio (PBR) of 1 at an early stage

In 2023, the Tokyo Stock Exchange issued a request to all listed companies for the improvement of PBR of below 1. ShinMaywa’s PBR has been less than 1 for many years, so we feel heavy significance in the fact that the formula for calculating PBR (PBR = share price (price per share) ÷ net assets per share) contains “share price,” which is the integration of the share market’s evaluation of the company. Certainly, share prices are affected by market speculation, but those stocks that continue to achieve rises in both capital gains (gains from sale of shares) and income gains (retained earnings = dividends) generally have firm share prices. For this reason, we need to give concrete indications regarding

- 1.The implementation of management that will enable expectations of future growth

- 2. Sustainable improvement in profitability

As one measure for improving profitability, to obtain returns over and above investments, last year, we introduced the concept of an “inverted ROIC tree” on a workplace level, and we have been working to improve the various key performance indicators (KPI) set. Our intention is to integrate these activities to raise the ROIC of the entire Group.

In addition, as it is the mission of senior management to identify which businesses to invest in, last year, as a first step, we “visualized” the value of each business on a product level and shared that information. Going forward, using this as the basis for examining our business portfolio, we will reorganize the positioning of the individual businesses and concentrate management resources in growth businesses.

In this, the third year since the establishment of the Prime Market, there is already a sense that a filtering of the companies listed there has begun. In our aim to be a stock that the global market can expect to grow and not be resigned to our current position, as the officer in charge of finance, I will strive to earn proper evaluation through the implementation of management that is conscious of financial management and through careful disclosures. I hope we may rely on your ongoing support.