長期・中期経営計画

In order to continue to grow sustainably after celebrating our 100th anniversary in 2020, our group has established Long-term vision for the future, with 2030 as the target year, based on Management philosophy.

Currently, we are conducting business activities in accordance with Corporate principles, Action guidelines, and Code of conduct in order to "contribute to the overall well-being of humanyty bringing unstinting innovation," as stated in our "Management philosophy." In order to realize our "Long-term vision," we are promoting "long-term-oriented management" by concretely defining what we want the Group to be and backcasting to close the gap between that vision and the current situation.

長期ビジョン

制定 2020年4月1日

経営理念に基づき、新明和グループが目指す2030年の姿を表したものです。

To respond to global society needs,

we will be a true value co-creation company that advances

urban, transportation and environmental infrastructures.

Long-term management plan

Sustainable Growth with Vision 2030 ([SG-Vision2030])

- Sustainable growth through value creation -

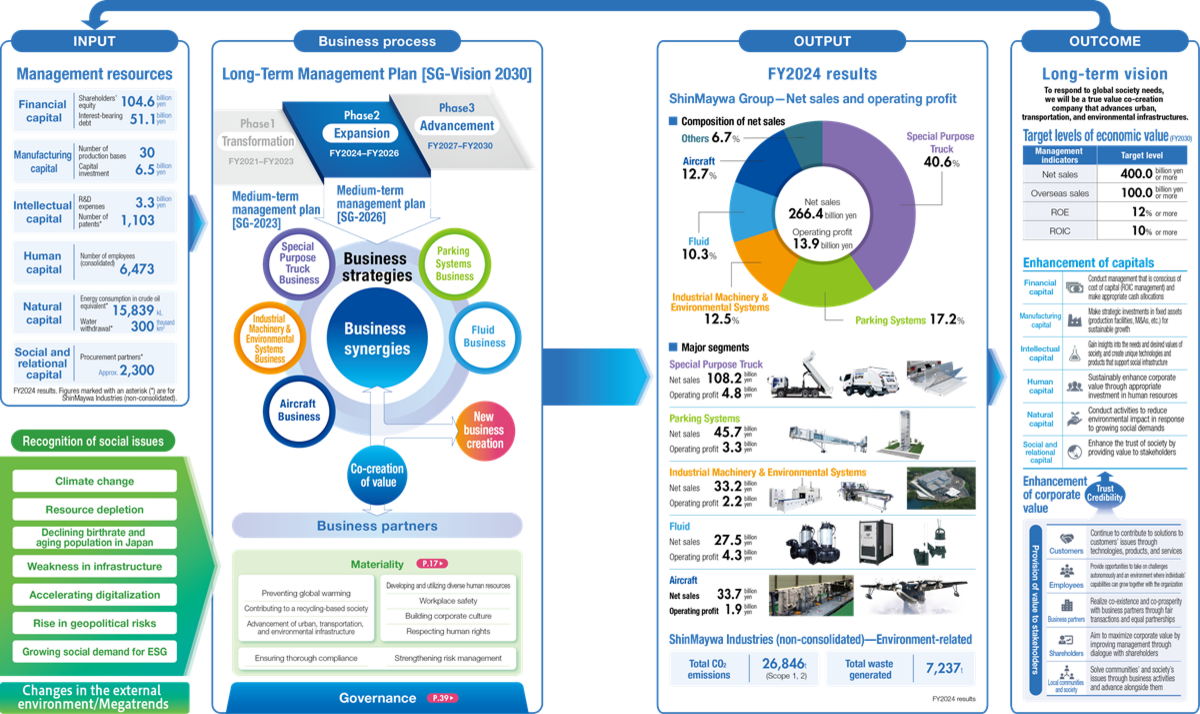

In order to continue achieving sustainable growth going forward, we will base our efforts on Management philosophy and set a future outlook with 2030 as our Long-term vision. By utilizing the management resources we have cultivated for over 100 years since our founding and the "six types of capital" we continue to accumulate through our business activities, we will strive to solve social issues and realize a sustainable future through our growth strategy (acceleration of overseas expansion, creation of new businesses, strategic M&A, and promotion of DX) and business portfolio strategy (providing value to stakeholders through five businesses).

Basic policy

The vision will be implemented with the following two management themes in parallel, improving corporate value by sustainably creating economic value and social value

- 1. "The Long-term business strategies": Lay out a future vision of society in 2030 and formulate and implement business solutions to achieve it

- 2. "Strengthening management foundations": Contribute to the SDGs through implementing sustainability management that supports Long-term business strategies

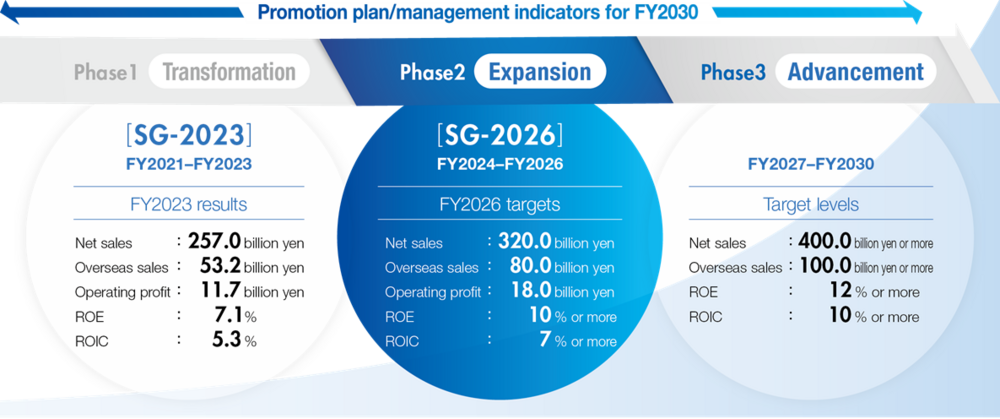

Promotion plan and target management indicators

The SG‐Vision 2030 period (FY2021 to FY2030) will be divided into three, with Medium‐term management plan for each period formulated and promoted, thus aiming to achieve the Long‐term vision and reach the various management indices.

Value Creation Process Conceptual Diagram

Medium-Term Management Plan[SG-2026]

SG-2026 (FY2024 - FY2026) is Phase 2 “Expansion” of the long-term management plan, SG-Vision 2030, which has FY2030 as its goal. It is positioned as the second step toward the long-term vision, in which we will work to accelerate growth.

While steadily dealing with the issues that have already become apparent in SG-2023, we will work toward this expansion under the following six basic policies.

Basic policy

A)Acceleration of overseas expansion:Strengthen development in Southeast Asia, Oceania, and North America

B)DX promotion:Make proactive use of M&As for overseas expansion and new business creation

C)Promotion of DX:Create value and develop new business models through utilization of data

D)New business creation: Create new businesses through business synergies and value co-creation with external parties

A)Implement business portfolio management by categorizing the five businesses into “growth potential enhancement businesses” and “profitability enhancement businesses,” based on ROIC.

B)Aim to achieve SG-Vision 2030 through investments and new business creation based on these portfolio categories

A)Deployment of inverted ROIC tree:Increase throughput, reduce operating expenses, and significantly improve productivity in all divisions and Group companies

B)Cash allocation: Increase ROIC through investment strategies in line with business portfolio strategy and procure funds with financial soundness in mind

A)Recruitment and development of human resources in line with growth strategies: Digital literacy education, global human resources education, recruitment of highly specialized human resources, and strategic human resources portfolio

B)Enhancement of employee engagement: D&I promotion, support for employees’ career development, development of female leaders

A)Environment: Extend calculations of Scope 1 and 2 for GHG emissions to Group companies and introduce Scope 3, and consider green product certification system

B)Society: Enhance corporate value by expanding the value provided to stakeholders

A)Risk management: Monitor business risks arising from climate change and human rights issues and implement CSR measures. BCM/ BCP responses,* strengthening of information security measures, etc.

B) Compliance:Continue to conduct compliance education and compliance awareness surveys, and strengthen utilization of the whistleblowing contact points

- ※BCM:Business Continuity Management ※/BCP:Business Continuity Plan

Management Indicator

| Management Indicator | FY2024 (Results) | [SG-2026](Target standard) |

|---|---|---|

| Net Sales | 266.4 billion yen | 320 billion yen |

| Overseas sales | 45.1 billion yen | 80 billion yen |

| Operating Profit | 13.9 billion yen | 18 billion yen |

| ROE(%) | 8.2% | 10% or more |

| ROIC(%) | 6.0% | 7% or more |

| Exchange rate (1 US dollar) | 152.1 yen | 140 yen (set value) |

| Segment | Net Sales | Operating Profit | ||||

|---|---|---|---|---|---|---|

| FY2024 (results) |

[SG-2026] (target) |

Growth rate | FY2024 (results) |

[SG-2026] (target) |

Growth rate | |

| 特装車 | 1,082 | 1,322 | 122% | 48 | 73 | 149% |

| パーキングシステム | 457 | 581 | 127% | 33 | 45 | 135% |

| Industrial Machinery & Environmental Systems | 332 | 435 | 131% | 22 | 34 | 154% |

| Fluid | 275 | 280 | 102% | 43 | 45 | 103% |

| 航空機 | 337 | 389 | 115% | 19 | 27 | 137% |

| Others | 180 | 183 | 102% | 14 | 10 | 68% |

| New businesses | ― | 10 | ― | -4 | -18 | ― |

| Adjustment | ― | ― | ― | -37 | -36 | ― |

| Total | 2,664 | 3,200 | 120% | 139 | 180 | 129% |

[SG-2026]Growth strategies

| Acceleration of overseas expansion | Strengthening collaboration between segments and alliances with local companies |

|

|---|---|---|

| New business creation | Taking on the challenge of creating new businesses: Led by the New the Business strategies Headquarters, we will promote "co-creation" by leveraging our "strengths" across segments. |

|

| Strategic M&As | Utilizing strategic M&A and creating value through co-creation |

|

| Promotion of DX | Business process reform | By standardizing and sharing value chain data, we will promote smarter operations and data aggregation, and build a "management platform" that enables information visualization and rapid decision-making. |

| Transform business model | Combining "customer data," "company data," and "open data," we will create new value through the use of AI/IoT and data analytics, and aim to transform our business model into one that provides solutions. |

Business portfolio management

Aim for “Advancement” from FY2027 in view of the goals of SG-Vision 2030

We will promote investment strategy by categorizing the five businesses into “growth potential enhancement businesses” and “profitability enhancement businesses” based on ROIC, and at the same time, work on the creation of new businesses through synergies among the five businesses and value co-creation with external parties.