Corporate Governance

As of June 24, 2025

The ShinMaywa Group conducts corporate activities in accordance with relevant laws and regulations, as well as with social norms and common sense, and also ensures transparency and rationality in its management in order to sustainably increase its corporate value. In doing so, we believe that it is vital to create and operate a corporate governance system and also to continuously review and improve that system.

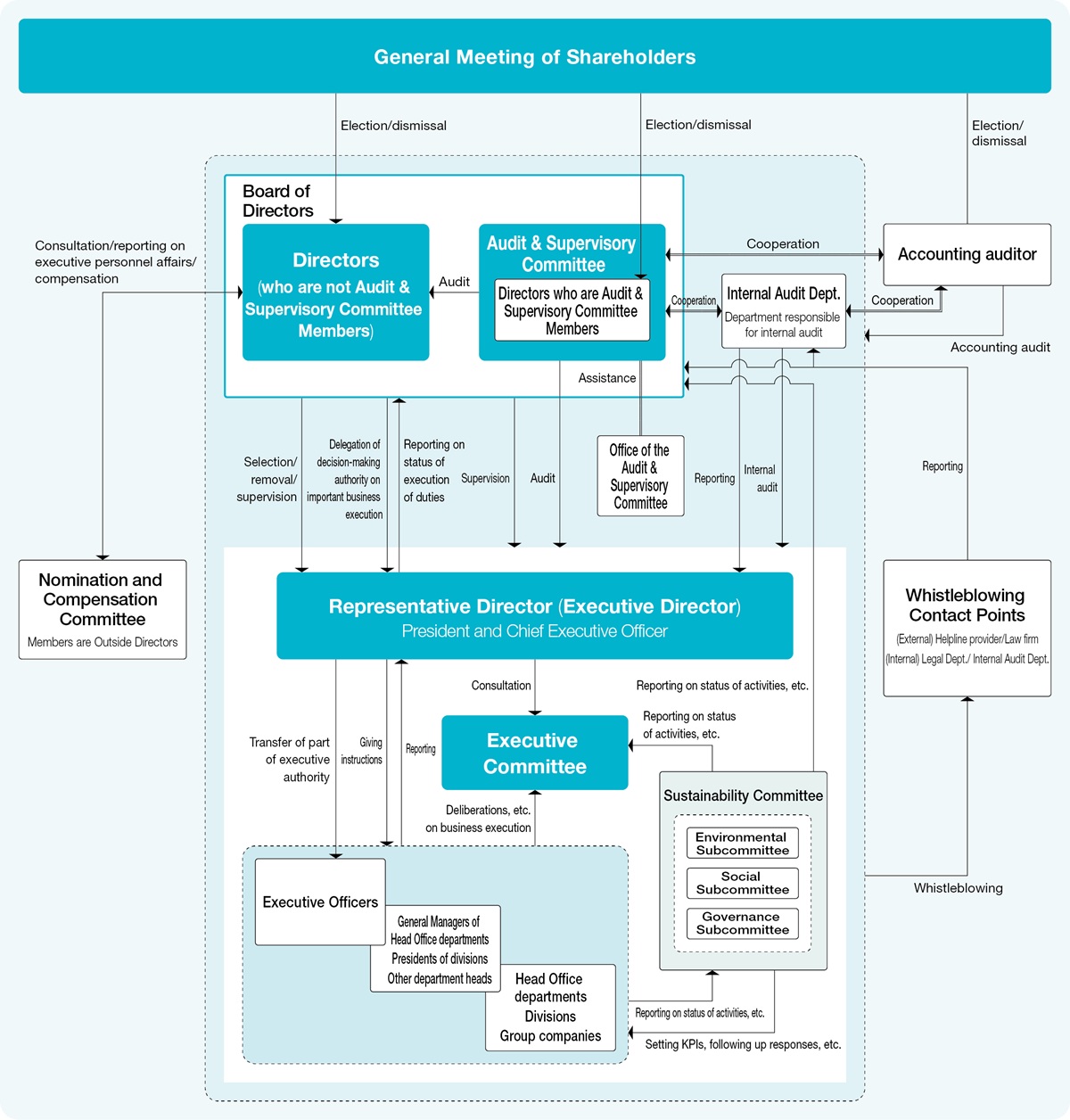

Overview of the corporate governance system and reasons for adopting the system

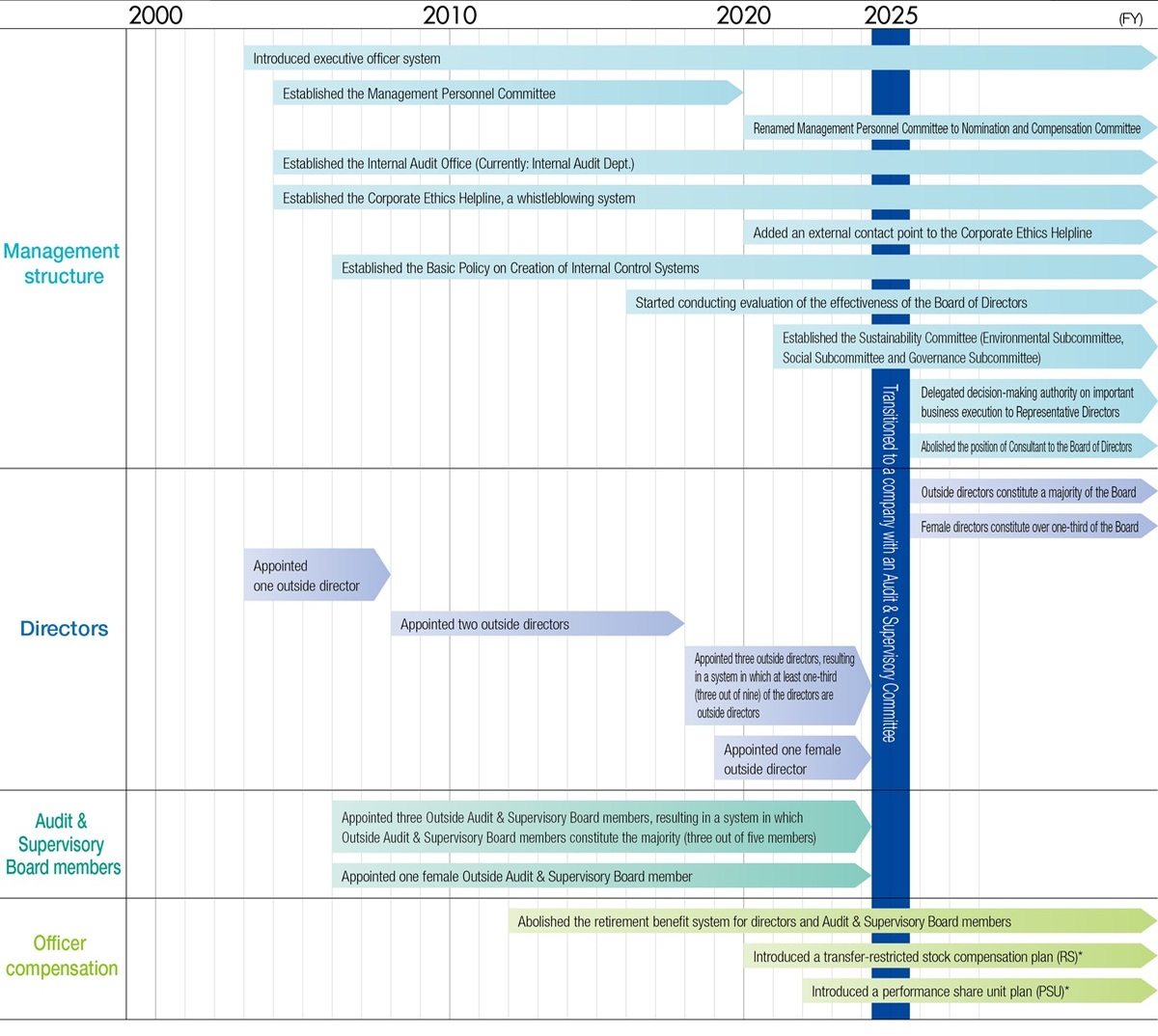

The Company transitioned from a "company with a board Audit & Supervisory Board Member" to a "company with an audit and supervisory committee" following approval at the 101st Ordinary General Meeting of Shareholders held on June 24, 2025. The purpose of this transition is to further improve the effectiveness of the supervisory function of Board of Director Meeting and strengthen the audit system by appointing directors who are audit and supervisory committee members with voting rights on Board of Director Meeting and establishing an audit and supervisory committee with a majority of its members being outside directors, and by promoting cooperation between the audit and supervisory committee and the internal audit department, and by delegating the Board of Director Meeting' authority to make decisions on business execution to directors, to expedite management decision-making and business execution under the appropriate supervision of Board of Director Meeting.

The diagram below provides an overview of our corporate governance system.

Corporate Governance System

Governance system timeline

Board of Director Meeting

In principle, Board of Director Meeting meets once a month to discuss and consider important management issues based on the medium- to long-term management plan, and to appropriately supervise the execution of duties by directors.

Our company currently has 10 directors (four of whom are Audit and Supervisory Committee members). Of these, six are outside directors (three of whom are Audit and Supervisory Committee members), making the majority of Board of Director Meeting outside directors. In addition, with the appointment of four female directors (two of whom are Audit and Supervisory Committee members), more than one-third of Board of Director Meeting is made up of women, and the composition of the Board of Directors takes gender diversity into consideration.

The Outside Directors are mainly expected to monitor management of the Company from an objective position that is independent of the management personnel, provide advice on management and provide broad and diverse perspectives for realizing increasing corporate value and sustainable growth over the medium to long term. They are selected from among persons who have management experience and other diverse experience, skills, and expertise and are effectively independent of the Company.

Audit and Supervisory Committee

The Audit and Supervisory Committee audits and supervises the execution of duties by directors in accordance with the audit plan. Directors who are Audit and Supervisory Committee members attend important internal meetings, including meetings of Board of Director Meeting, and also hear reports on the status of execution of duties by executives and employees, and inspect approval documents, thereby appropriately fulfilling their audit and supervisory functions.

The outside directors who serve as Audit and Supervisory Committee members are selected from among lawyers, certified public accountants, and individuals with backgrounds in other companies. They express their opinions regarding the execution of duties by directors based on their respective areas of expertise, thereby ensuring the neutrality and effectiveness of audits.

Directors who are Audit and Supervisory Committee members hold regular meetings with the President and CEO to receive reports on management and business conditions, and exchange opinions based on the status of audits and audit findings.In addition, with the aim of enriching discussions at Board of Director Meeting, outside directors who are not Audit and Supervisory Committee members exchange information and opinions.

Accounting auditor

Grant Thornton Taiyo LLC has been appointed as the accounting auditor, and by providing accurate management information, we have created envrionment where accounting audits can be conducted from a fair standpoint.

Nomination and Compensation Committee

With the aim of further enhancing the transparency and appropriateness of personnel matters and compensation for management, the Company has voluntarily established Nomination and Compensation Committee, which is consulted in advance when selecting candidates for officers and determining their compensation and bonuses.

The committee is composed exclusively of outside directors, ensuring its independence and fairness.

Sustainability Committee

We aim to conduct management from a long-term perspective and have established a Sustainability Committee to address various issues related to ESG (Environment, Social, Governance) in corporate management. At this meeting, we identify important issues (materiality), set KPIs, follow up and supervise the progress of deliberations in subcommittees (environmental subcommittee, social subcommittee, governance subcommittee) regarding each element of ESG, and monitor KPIs. The Board of Directors confirms the status of achievement of goals, reviews plans, and reports the status to the Board of Directors (as a general rule, twice a year).

Executive Committee

The meeting is held multiple times a month depending on the agenda, with the purpose of formulating company-wide management strategies, deliberating and reporting important matters related to business execution, and deliberating Medium-term management plans.

Internal Audit Department

The Audit Department, which consists of 10 members, is responsible for internal audits within the Group. Based on the annual audit plan, the Audit Department verifies whether internal controls are functioning effectively at the Company and its Group companies, and makes proposals for improvements and efficiency based on the results. The Audit Department also compiles audit reports on the results of internal audits and reports them to Board of Director Meeting.

The Audit and Supervisory Committee, accounting auditors, and the Audit Department, which is the internal audit division, work together and coordinate to ensure efficient audits.

執行役員

The Company has adopted an executive officer system intended to strengthen management functions by transferring authority over individual business operations to executive officers in order to speed up decision-making processes and clarify executives’ responsibilities while freeing up the Board members (Board of Directors) to focus on evaluating individual businesses, making decisions about the allocation of management resources, and exercising supervision over business operations from a company-wide perspective. Through this executive officer system, the Company aims to enhance its corporate governance and realize higher operational efficiency.

The Company has 21 executive officers (two of whom also serve as directors), whose main duties are to carry out individual businesses.

| Name | Position/responsibility at the Company |

|---|---|

| 久米 俊樹 | Director, Member of the Board / Managing Executive Officer |

| 椢原 敬士 | Director, Member of the Board Managing Executive Officer, Vice President of New Business Strategic Division [Monozukuri Management] |

| 中野 恭介 | Managing Executive Officer Parking Systems Division (Sales and Global) |

| 田中 克夫 | Managing Executive Officer, Chief Engineer (Technical) |

| 小田 浩一郎 | Managing Executive Officer, Head of Corporate Planning Division (in charge of Sustainability and DX) |

| 田村 功一 | Managing Executive Officer Fluid Division and General Manager of Business Promotion Division (Deputy in charge manufacturing) |

| 新居 聡 | Managing Executive Officer, General Industrial Machinery Systems Division (Deputy Global Manager) |

| 望田 秀之 | Managing Executive Officer Aircraft Division and General Manager of Technology Headquarters (Deputy in charge of Technology) |

| Takeshi Masuda | Managing Executive Officer, General Special Purpose Truck Division (Deputy in charge of Sustainability) |

| 小西 宏明 | Managing Executive Officer, General Manager of Human Resources and General Affairs Department (in charge of human resources training) |

| 深井 浩司 | Executive Officer, Corporate Planning Division, Digital Promotion Department Manager (Deputy DX Manager) |

| 長尾 嘉宏 | Executive Officer, General Manager of Sano Plant Special Purpose Truck Division |

| 中瀬 雅嗣 | Executive Officer/ Senior Vise President, Parking Systems Division |

| 穐本 崇 | Executive Officer, General Manager of New Business Promotion Special Purpose Truck Division Division |

| 石原 秀朝 | Executive Officer, Deputy General Manager Special Purpose Truck Division |

| 難波 政浩 | Executive Officer/ Senior Vise President, Parking Systems Division/ General Manager, Business Planning Office of the Division |

| 桑原 一郎 | Executive Officer/ Senior Vise President, Industrial Machinery Systems Division / General Manager, Enviromental Systems Department of the Division |

| Yasutaka Matsumoto | Executive Officer, General Manager of Legal Affairs |

| Satoshi Nagai | Executive Officer, Deputy General Manager Fluid Division and General Manager of Sales Division (Deputy Sales Officer) |

| Takeshi Ninomiya | Executive Officer, General Manager Special Purpose Truck Division Division |

| Takanori Yamaoka | Executive Officer, General Manager of the Audit Department and Head of the Audit and Supervisory Committee Office |

Regarding Board of Director Meeting and Other Committees Voluntarily Established regarding Corporate Governance

Activities of Board of Director Meeting

In principle, Board of Director Meeting meets once a month, and in fiscal year 2024, it met a total of 13 times.

Board of Director Meeting meetings consider the status of efforts to address the various issues set out in the medium- to long-term management plan, such as new businesses, M&A, and cash allocation, as well as the risk management system, business portfolio management, the operation of the internal control system, and important capital investments.

The attendance status of individual Directors and Audit & Supervisory Board Member at Board of Directors meetings is as follows.

| Position on Board of Director Meeting | Job title | Name | Number of attendance (attendance rate) |

|---|---|---|---|

| Chairman | 代表取締役 取締役社長 | 五十川 龍之 | 13/13 times (100%) |

| Director, Member of the Board/ Deputy Chief Executive Officer | 石丸 寛二 | 13/13 times (100%) | |

| Director, Member of the Board/ Senior Managing Executive Officer | 西岡 彰 | 13/13 times (100%) | |

| Director, Member of the Board/ Managing Executive Officer | 久米 俊樹 | 13/13 times (100%) | |

| Director, Member of the Board/ Managing Executive Officer | 椢原 敬士 | 13/13 times (100%) | |

| Outside Director, Member of the Board | 苅田 祥史 | 13/13 times (100%) | |

| Outside Director, Member of the Board | 長井 聖子 | 13/13 times (100%) | |

| Outside Director, Member of the Board | 梅原 俊志 | 13/13 times (100%) | |

| Full-Time Audit & Supervisory Board Member | 西田 幸司 | 13/13 times (100%) | |

| Full-Time Audit & Supervisory Board Member | 島坂 忠宏 | 13/13 times (100%) | |

| 社外監査役 | 金田 友三郎 | 13/13 times (100%) | |

| 社外監査役 | 杦山 栄理 | 13/13 times (100%) | |

| 社外監査役 | 木村 文彦 | 13/13 times (100%) |

Activities of Nomination and Compensation Committee

Nomination and Compensation Committee met five times in fiscal year 2024.

Nomination and Compensation Committee considered the implementation of the succession plan, the selection of candidates for directors and executive officers, and compensation levels.

| Position on Nomination and Compensation Committee | Job title | Name | Number of attendance (attendance rate) |

|---|---|---|---|

| Chairman | Outside Director, Member of the Board | 苅田 祥史 | 5/5(100%) |

| Outside Director, Member of the Board | 長井 聖子 | 5/5(100%) | |

| Outside Director, Member of the Board | 梅原 俊志 | 5/5(100%) | |

| 代表取締役 取締役社長 | 五十川 龍之 | 5/5(100%) |

Activities of the Sustainability Committee

Sustainability Committee is generally held once every six months, and was held twice in fiscal 2024.

At Sustainability Committee, we monitored the progress of important issues (materiality) and KPIs related to ESG (Environment, Social, Governance), and also considered setting new materiality.

| Position on the Sustainability Committee | Job title | Name | Number of attendance (attendance rate) |

|---|---|---|---|

| Chairman | Director, Member of the Board/ Deputy Chief Executive Officer | 石丸 寛二 | 2 /2 times (100%) |

| Director, Member of the Board/ Senior Managing Executive Officer | 西岡 彰 | 2 /2 times (100%) | |

| Director, Member of the Board/ Managing Executive Officer | 久米 俊樹 | 1 /2 times (50%) | |

| Full-Time Audit & Supervisory Board Member | 西田 幸司 | 1 /2 times (50%) | |

| Full-Time Audit & Supervisory Board Member | 島坂 忠宏 | 2 /2 times (100%) |

Activities of the Executive Committee

Executive Committee is held multiple times each month depending on the agenda, and a total of 25 meetings were held in fiscal 2024.

At Executive Committee, preliminary deliberations were held on the agenda items to be submitted to the aforementioned Board of Director Meeting meeting, the progress of the Medium-Term Management Plan [SG-2026], and issues in the execution of individual businesses.

| Position on the Executive Committee | Job title | Name | Number of attendance (attendance rate) |

|---|---|---|---|

| Chairman | 代表取締役 取締役社長 | 五十川 龍之 | 25 /25 times (100%) |

| Director, Member of the Board/ Deputy Chief Executive Officer | 石丸 寛二 | 25 /25 times (100%) | |

| Director, Member of the Board/ Senior Managing Executive Officer | 西岡 彰 | 25 /25 times (100%) | |

| Director, Member of the Board/ Managing Executive Officer | 久米 俊樹 | 25 /25 times (100%) | |

| Director, Member of the Board/ Managing Executive Officer | 椢原 敬士 | 25 /25 times (100%) | |

| Full-Time Audit & Supervisory Board Member | 西田 幸司 | 25 /25 times (100%) | |

| Full-Time Audit & Supervisory Board Member | 島坂 忠宏 | 25 /25 times (100%) |

- *In addition to the above, Executive Officers who are business managers and other designated persons will attend depending on the agenda.

Officer Compensation

1. Matters related to policies regarding the determination of the amount of ompensation, etc. for Directors and its calculation method

The Company's policy regarding determining the amount of compensation, etc. for Directors and its calculation method is as follows.

Matters regarding determination of compensation, etc. for individual directors

- 1 Basic

Policy regarding Officer compensation

- We will create a compensation system that motivates "medium- to long-term performance improvement" and "sustainable improvement of corporate value" based on Management philosophy and Long-term vision.

- In order to realize Long-term vision, we will set compensation levels with incentives to secure and retain excellent management personnel.

- The compensation system is highly objective and transparent, ensuring accountability to stakeholders, and is decided fairly by resolution of Board of Director Meeting after deliberations at Nomination and Compensation Committee, which is comprised of the President and three Outside Directors. The Nomination and Compensation Committee is made up of three Outside Directors (excluding Directors who are Audit and Supervisory Committee Members), and the Chairperson is selected by mutual vote of the committee members.

- 2 Executive compensation system

- Executive compensation consists of monthly compensation (fixed compensation), bonuses (performance-based compensation), restricted stock compensation (non-monetary compensation), and performance-linked stock compensation (non-monetary compensation). However, in consideration of their role of overseeing the Company's management from an independent and objective standpoint, Outside Directors, and in consideration of their role of auditing the Company's management from an objective standpoint, will only receive monthly compensation (fixed compensation).

- Monthly compensation (fixed compensation) is determined within the range approved at the general meeting of shareholders, taking into account job responsibilities.

- Bonuses (performance-linked compensation) are based on the current profit of the relevant business year, within the scope approved at the general meeting of shareholders, and are based on operating profit, ROIC, and the medium- to long-term efforts made in the current fiscal year to achieve the "realization of medium- to long-term strategies." We will take these factors into account and make decisions based on comprehensive consideration.

- Restricted stock compensation (non-monetary compensation) will be determined according to position within the scope approved at the General meeting of shareholders.

- Performance-linked stock compensation (non-monetary compensation) is determined within the scope approved at the General meeting of shareholders, depending on the position, term of office, and degree of achievement of performance targets during the Medium-term management plan period.

- 3Policies regarding the method for determining officer compensation

- In order to increase the transparency of the procedures for determining compensation of Directors (excluding Directors who are Audit and Supervisory Committee Members) and the appropriateness of the content, the Nomination and Remuneration Committee is consulted in advance when determining compensation of Directors (excluding Directors who are Audit Nomination and Compensation Committee).

- The Board of Directors has the authority to decide on the amount of compensation for each Director (excluding Directors who are Audit and Supervisory Committee Board of Director Meeting) and the policy regarding the calculation method thereof, and will make a resolution at Board of Director Meeting meeting based on the deliberations and recommendations of Nomination and Compensation Committee.

- 4 Policy

regarding determining the amount of monthly compensation (fixed compensation), bonus (performance-based compensation) and its calculation method

- With regard to monthly compensation (fixed compensation) and bonuses (performance-based compensation) for directors (excluding directors who are audit and supervisory committee members), a resolution was passed at the Ordinary General Meeting of Shareholders held on June 24, 2025, that the total amount of such compensation to be paid shall be no more than 520 million yen per year (of which, for outside directors, monthly compensation (fixed compensation) alone shall be no more than 120 million yen per year in total. This does not include the employee salaries of directors who also serve as employees). At the time of the resolution at the Ordinary General Meeting of Shareholders, the number of directors (excluding directors who are audit and supervisory committee members) was six (including three outside directors).

Furthermore, with regard to the monthly compensation (fixed compensation) of directors who are Audit and Supervisory Committee members, a resolution was passed at the Ordinary General Meeting of Shareholders held on June 24, 2025, limiting the total amount of such compensation to be paid to no more than 120 million yen per year. At the time of the resolution at the Ordinary General Meeting of Shareholders, there are four directors who are Audit and Supervisory Committee members (including three outside directors). - When determining the amount of compensation for Directors (excluding Directors who are Audit and Supervisory Committee Members), Nomination and Compensation Committee is consulted in advance, and the Committee deliberates on the level of monthly compensation (fixed compensation) by position, with reference to the public average, and on the level of bonuses (performance-based compensation) by position, with the net income attributable to owners of the parent being the basis.

As part of the activities of Board of Director Meeting and Nomination and Compensation Committee in determining the amount of compensation for the Company's Directors for the fiscal year under review, Nomination and Compensation Committee held meetings in February 2024 and March 2025 deliberated on the amount, and Board of Director Meeting made a resolution based on the deliberations and recommendations of Nomination and Compensation Committee. - The indicators for bonuses (performance-based compensation) are consolidated operating profit, consolidated ROIC, and net profit attributable to owners of the parent company. These indicators were selected because the Company places importance on consolidated operating profit generated through business activities, the ratio of operating profit after tax to invested capital, and net profit attributable to owners of the parent company, which serves as the source of shareholder dividends. The method for determining the amount of bonuses (performance-based compensation) is to set a level for the President & CEO based on net profit attributable to owners of the parent company, multiply the President's level by a coefficient for each position to set a level for each position, and then determine individual amounts by taking into account the increase or decrease in consolidated operating profit and consolidated ROIC of the divisions in charge, as well as medium- to long-term factors addressed in the fiscal year toward "realizing the medium- to long-term strategy."

- With regard to monthly compensation (fixed compensation) and bonuses (performance-based compensation) for directors (excluding directors who are audit and supervisory committee members), a resolution was passed at the Ordinary General Meeting of Shareholders held on June 24, 2025, that the total amount of such compensation to be paid shall be no more than 520 million yen per year (of which, for outside directors, monthly compensation (fixed compensation) alone shall be no more than 120 million yen per year in total. This does not include the employee salaries of directors who also serve as employees). At the time of the resolution at the Ordinary General Meeting of Shareholders, the number of directors (excluding directors who are audit and supervisory committee members) was six (including three outside directors).

- 5 Policy regarding determining the amount of restricted stock compensation (non-monetary compensation) and its calculation method

- Restricted stock compensation (non-monetary compensation) is separate from the monthly compensation (fixed compensation) and bonuses (performance-based compensation) described above, and will be decided by the Board of Directors within the upper limit of the total amount of monetary compensation claims (up to 50 million yen per year) and the upper limit of the number of the Company's common shares that may be issued or disposed of by paying the entire amount as in-kind contribution (up to 75,000 shares per year) determined by a resolution at the Ordinary General Board of Director Meeting held on June 24, 2025.

- When determining the amount of restricted stock compensation, Nomination and Compensation Committee is consulted, and the committee will deliberate and report on the level of restricted stock compensation to be granted, taking into account the public standards for each position, and Board of Director Meeting will then make a resolution.

- 6 Policy regarding determining the amount of performance-linked stock compensation (non-monetary compensation) and its calculation method

- Performance-linked stock compensation (non-monetary compensation) is separate from the monthly compensation (fixed compensation), bonuses (performance-based compensation), and restricted stock compensation (non-monetary compensation) described above, and will be decided by the Board of Directors within the upper limit of the total amount of monetary compensation claims (up to 400 million yen per year) and the upper limit of the number of the Company's common shares that may be issued or disposed of by paying the entire amount as in-kind contributions (up to 600,000 shares per year), as determined by a resolution at the Ordinary General Board of Director Meeting held on June 24, 2025.

The performance evaluation period is expected to be a maximum of four fiscal years, so each fiscal year will be equivalent to an annual amount of up to 100 million yen and up to 150,000 shares. - When determining the amount of performance-linked stock compensation, Nomination and Compensation Committee is consulted, and the Board of Board of Director Meeting then makes a resolution based on the results of the committee's deliberations and recommendations regarding the level of performance-linked stock to be granted by position based on the degree of achievement of performance targets.

- Performance-linked stock compensation (non-monetary compensation) is separate from the monthly compensation (fixed compensation), bonuses (performance-based compensation), and restricted stock compensation (non-monetary compensation) described above, and will be decided by the Board of Directors within the upper limit of the total amount of monetary compensation claims (up to 400 million yen per year) and the upper limit of the number of the Company's common shares that may be issued or disposed of by paying the entire amount as in-kind contributions (up to 600,000 shares per year), as determined by a resolution at the Ordinary General Board of Director Meeting held on June 24, 2025.

- 7Policy regarding determining the ratio of monthly compensation, performance-based compensation, and non-monetary compensation

- Our officer compensation consists of monthly compensation (fixed compensation), bonuses (performance-based compensation), restricted stock compensation (non-monetary compensation), and performance-linked stock compensation (non-monetary compensation). Since the amount of bonuses (performance-linked compensation) and the amount of performance-linked stock compensation (non-monetary compensation) vary according to each medium-term management plan, the payment ratio will vary from year to year. .

Policy regarding determining the timing and conditions of compensation

The timing of giving compensation will be as follows.

- Monthly compensation (fixed compensation): Every month from July onwards

- Bonus (performance-based compensation): July

- restricted stock compensation (non-monetary compensation): July (annual amount granted in one lump sum)

- Performance-linked stock compensation (non-monetary compensation): July of the year following the final performance year of the Medium-term management plan (granted in one lump sum for the period of the Medium-term management plan)

In the case of compensation determination is delegated to a Director or other third party

- Name or position of the person receiving the delegation

Tatsuyuki Isogawa, Representative Director and President & CEO - Contents of authority to be delegated

Amounts of monthly compensation (fixed compensation), bonuses (performance-based compensation), restricted stock compensation (non-monetary compensation), and performance-linked stock compensation (non-monetary compensation) for each director (excluding directors who are audit and supervisory committee members) - If measures are taken to ensure that the delegate exercises his/her authority appropriately, the details of such measures

Nomination and Compensation Committee deliberates on the level of monthly compensation (fixed compensation), bonuses (performance-based compensation remuneration), restricted stock compensation remuneration (non-monetary compensation remuneration), and performance-linked stock compensation (non-monetary compensation) for each director (excluding directors who are Audit and Supervisory Committee members), and those delegated the decision are to determine the specific payment amounts based on the results of deliberations by the committee. - Reasons to Delegate

The evaluation of the work of directors (excluding directors who are Audit and Supervisory Committee members) should be carried out by the Representative Director, who is in a position to grasp in detail and from a bird's-eye view the content of the work each director is responsible for and the specific efforts each director is making in relation to those work. Therefore, the above authority has been delegated to the Representative Director. - The reason why Board of Director Meeting determined that the details of compensation for each individual Director are in line with the decision-making policy

When determining compensation of individual directors (excluding directors who are Audit and Supervisory Committee members), Nomination and Compensation Committee deliberates on the remuneration, including whether it is consistent with the above-mentioned policy. The details of compensation of individual directors (excluding directors who are Audit and Supervisory Committee members) are determined based on the results of these deliberations, and we believe that the details of such decisions are in line with the above-mentioned policy.

Method for determining the compensation for each director (excluding directors who are audit and supervisory committee members)

- Monthly compensation (fixed compensation)

It is determined as follows: supervisory compensation (a flat, same amount), advisory compensation (applicable to outside directors, a flat, same amount), representative compensation (applicable to representative directors, a flat, same amount), and executive compensation (not applicable to outside directors, a flat, same amount by position). - Bonus (performance-based compensation)

Decisions will be made based on the performance evaluation of the department in charge. Please note that no compensation will be paid to Outside Directorrs. - Restricted stock compensation (non-monetary compensation)

Determined by supervisory compensation (uniformly the same amount) and executive compensation (uniformly the same amount depending on position). Please note that this allowance is not paid to Outside Directors. - Performance-linked stock compensation (non-monetary compensation)

The standard number of shares to be delivered will be determined according to the status of the performance evaluation period, and the Company's shares will be paid based on the period of office and the degree of achievement of performance targets. Please note that this allowance is not paid toOutside Directors.

The method for calculating the individual final number of shares to be delivered to each Eligible Director under the Plan is as follows.

"Final number of shares to be delivered = standard number of shares to be delivered x term of office x performance target achievement level"

Standard number of shares to be delivered

Standard number of shares to be issued = Standard stock compensation amount by role / Standard stock price

Standard stock price

The closing price of the Company's common stock on the Tokyo Stock Exchange on the start date of the performance evaluation period (if no trade is concluded on the same day, the closing price on the most recent trading day preceding it).

Term of office

Term of office = Number of months in office / 12

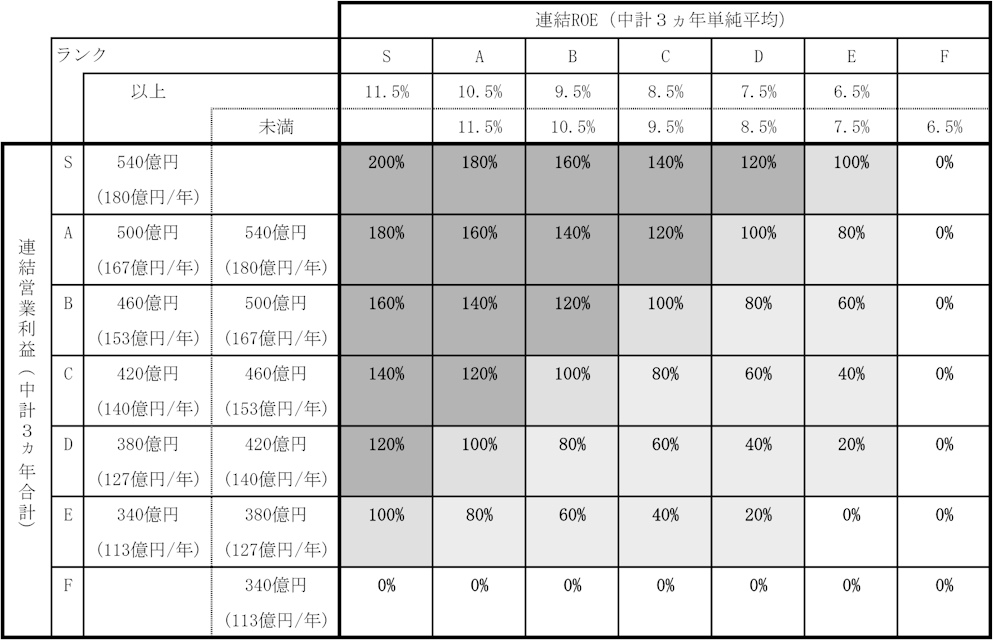

Achievement of performance goals

(A) Performance evaluation period and performance evaluation indicators

| Performance evaluation period | Three fiscal years from the fiscal year ending March 2025 to the fiscal year ending March 2027 |

|---|---|

| performance evaluation indicators | Three-year cumulative consolidated operating profit and three-year simple average consolidated ROE |

(B) Specific calculation method

The degree of achievement of performance targets is determined by the three-year cumulative consolidated operating profit and three-year simple average consolidated ROE calculated from the consolidated balance sheet and consolidated income statement for each fiscal year corresponding to the Company's performance evaluation period. Based on the following calculations:

Calculation method for performance target achievement

2. Total amount of compensation, etc. by officer category, total amount of compensation, etc. by type, and number of eligible officers

| Officer classification | Total amount of compensation, etc. (illion yen) |

Total amount of compensation, etc. (million yen) | Number of eligible officers (persons) | |||

|---|---|---|---|---|---|---|

| Monthly compensation (Fixed compensation) |

Bonus (performance-based compensation) |

Restricted stock compensation (Non-monetary compensation) |

Performance-linked stock compensation (non-monetary compensation) | |||

| Directors, Board of Director (excluding Outside Directors) | 300 | 153 | 88 | 31 | 27 | 6 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) | 36 | 36 | - | - | - | 2 |

| Outside officers | 46 | 46 | - | - | - | 6 |

- *1 As of the end of the current fiscal year (March 31, 2025), there are 13 directors and Audit & Supervisory Board Member (8 directors and 5 Audit & Supervisory Board Member).

- *2 The amount of compensation for Directors does not include the employee salary for Directors who also serve as employees.

- *3 It was resolved at the 88th Ordinary General Meeting of Shareholders held on June 26, 2012 that the maximum amount of compensation for Audit & Supervisory Board Members would be no more than 5 million yen per month.

- *4 Of performance-based compensation, the amount of stock compensation (non-monetary compensation) is the amount recorded as expense for the current fiscal year based on the performance-linked stock compensation system, which records expenses over the medium-term management plan period, which is the performance evaluation period.

Evaluation of the effectiveness Board of Director Meeting and content of questionnaire surveys, etc.

The Company commissions an external organization to conduct a questionnaire survey (combining a five-point rating system and a free description system) every year to evaluate the effectiveness of Board of Director Meeting among directors and Audit & Supervisory Board Member attend Board of Director Meeting meetings.

As the survey showed a large number of positive evaluations, we believe that the directors and Audit & Supervisory Board Member believe that the effectiveness of our Board of Director Meeting is being ensured.

However, in the free-form responses to the questionnaire survey, many respondents actively expressed their opinions regarding further improving the effectiveness of Board of Director Meeting.

Based on these opinions, Board of Director Meeting will take the following measures to further improve the effectiveness of Board of Director Meeting, including improving its supervisory function.

i) After clearly defining important management issues to be discussed at Board of Director Meeting, such as "business portfolio management" and "ROIC improvement," the Company will formulate an annual agenda plan and schedule and conduct systematic deliberations. In addition, the Company will distribute and explain summaries of discussions and issues at Board of Director Meeting meetings to officers and related departments, etc., to thoroughly share awareness and promote and strengthen efforts to address issues, thereby further enhancing and deepening discussions at Board of Director Meeting.

ii) We will promote the systematization and regularization of executive training, including e-learning, and expand the scope of participants to develop and enhance the capabilities of executive management and candidates.

Other matters related to corporate governance

In order to develop a system to ensure the appropriateness of business operations, our Board of Directors has established the "Basic Policy on Creation of Internal Control Systems."

The contents are as follows.

System to ensure that the execution of duties by Directors complies with laws and regulations and the Articles of Incorporation

Our company conducts corporate activities in compliance with laws, regulations and social norms based on the "Corporate principles", "Management philosophy," "Action guidelines," and "Code of conduct."

The Representative Director shall make decisions regarding business execution in accordance with resolutions of Board of Director Meeting, delegation of important business execution decisions from Board of Director Meeting pursuant to the provisions of the Articles of Incorporation, and internal rules such as the Rules for Approval Processes and Rules for the Division of Duties, and shall execute business operations together with other executive directors. Board of Director Meeting, which includes outside directors with no conflicts of interest, shall oversee this, and the Audit and Supervisory Committee shall audit the appropriateness of such decisions.

In order to further enhance the objectivity and appropriateness of appointments and compensation for Directors, Board of Director Meeting will consult in advance with Nomination and Compensation Committee, which is composed solely of Outside Directors, on matters related to such appointments and compensation, and will make decisions based on the committee's recommendations.

In addition, the Company will establish a "Sustainability Committee" for the purposes of examining management policies, issues and indicators related to Corporate Social Responsibility (CSR), and monitoring the progress of achieving these issues.

In addition, we have set up an internal reporting hotline (corporate ethics helpline) to ensure early detection of problematic events and the elimination of compliance risks through self-correction.

System for storing and managing information related to the execution of duties by Directors

The Company records information related to the execution of duties by directors in documents or electromagnetic media based on internal rules such as Board of Directors rules and approval rules, and retains the information for the period specified in the document handling rules.

Regulations and other systems for managing the risk of loss

The Company will develop internal rules and manuals, etc., with the departments in charge taking the lead in managing risks related to compliance, export control, information management, quality control, environmental management, and disasters, etc., and will provide education to employees, as well as provide timely information regarding thorough compliance with laws and regulations, in order to ensure their thorough implementation.

In addition, with regard to risks related to business execution, regulations stipulating risk management will be established, and each division will independently establish a risk management system that suits the characteristics of the business. On the other hand, at Head Office, each division We will establish a risk management system by monitoring the status of risk management and implementing company-wide risk countermeasures such as disaster risk and financial risk.

System to ensure that directors' duties are executed efficiently

The Company will delegate authority over the operation of individual businesses to executive officers, strengthening management functions by accelerating decision-making and clarifying responsibilities. The Company will also strive to strengthen corporate governance and improve operational efficiency through decision-making and oversight by directors regarding the evaluation of individual businesses and the allocation of management resources.

In addition, we will formulate annual and medium-term management plans that clarify the division of duties, authority, and responsibilities of the organizational and other business execution structures, and will review and revise these plans regularly.

System to ensure that the execution of duties by employees complies with laws and regulations and the Articles of Incorporation

In addition to the "Action guidelines" and "Code of conduct" that serve as guidelines for employees to act in accordance with laws and regulations, social norms, and social decency, the Company has established "ShinMaywa Corporate Ethics Day" and "Corporate Ethics Month" to promote the spread of awareness regarding compliance and the establishment of various systems.

Furthermore, the execution of duties by employees shall be carried out in accordance with laws and regulations, the Articles of Incorporation, the approval regulations, the division of duties and other internal rules. To verify this, the Internal Audit Department shall conduct internal audits, aiming to detect and eliminate compliance risks at an early stage, and shall endeavor to grasp a wide range of problematic events by utilizing the internal reporting system, etc.

System for ensuring the appropriateness of operations within the corporate group consisting of the Company and its subsidiaries

We share our "Corporate principles Credo," "Management philosophy," "Action guidelines," and "Code of conduct" with each of our group companies, and conduct our corporate activities in compliance with laws, regulations, and social norms.

In addition, based on the regulations stipulating the management of group companies, we may request reports from officers, employees, etc. (hereinafter referred to as "officers and employees") of each company in our group, as necessary, or communicate with the department in charge of our company. In addition, by dispatching our officers and employees as directors, Audit & Supervisory Board Member, etc. of each company in our group, we will strive to understand the status of business execution at each company in our group, and we will also strive to understand the status of business execution at each company in our group. We will promote reporting and discussions with the government.

In addition, we carry out internal audits led by the audit department, aiming to discover and eliminate compliance risks at an early stage, and broadly grasp problematic events by utilizing the whistle-blowing hotline that can be used by each company in our group.

Matters concerning directors and employees who assist the Audit and Supervisory Committee in its duties, and matters concerning the independence of such directors and employees from other directors of the Company (excluding directors who are Audit and Supervisory Committee members)

If the Audit and Supervisory Committee requests that employees be appointed to assist in its duties, the Company will establish an organization to assist the Audit and Supervisory Committee in its duties, assign such assistant employees, and provide support from relevant departments as necessary.

When an assistant employee is appointed to the Audit and Supervisory Committee, the opinions of the Audit and Supervisory Committee will be heard and respected regarding the transfer and evaluation of such employee.

Matters concerning ensuring the effectiveness of instructions to directors and employees who assist the Audit and Supervisory Committee in its duties

Our audit department will conduct internal audits in cooperation with the Audit and Supervisory Committee. The Audit and Supervisory Committee may issue necessary instructions regarding internal audits to the audit department, and if instructions different from those of the Audit and Supervisory Committee are issued by the Representative Director, the instructions of the Audit and Supervisory Committee will prevail.

A system for directors and employees to report to the Audit and Supervisory Committee, a system for other reporting to the Audit and Supervisory Committee, and a system to ensure that no one is treated unfavorably for making such a report

Directors who are Audit and Supervisory Committee members (hereinafter referred to as "Audit and Executive Committee Committee members") will receive reports from Board of Director Meeting or employees on the status of business execution and other important matters at the Board of Directors meetings, management meetings, and other important internal meetings they attend. In addition, upon request from the Audit and Supervisory Committee, they will receive reports on matters necessary for the Audit and Supervisory Committee to perform its duties. Furthermore, we strive to ensure that Audit and Supervisory Committee members have opportunities to regularly exchange opinions with the Representative Director and Outside Directors who are not Audit and Supervisory Committee members. We also strive to ensure that Audit and Supervisory Committee members have opportunities to exchange opinions and share information with officers and employees of the Company and each Group company. The audit department will report to the Audit and Supervisory Committee on the status and results of internal audits of the Company and each Group company. Furthermore, the Company will not treat officers or employees who report or make internal reports to the Audit and Supervisory Committee or whistle-blowing system regarding the performance of their duties in a detrimental manner.

Matters concerning the procedures for advance payment or reimbursement of expenses incurred in the execution of duties by the Audit and Supervisory Committee members (limited to those related to the execution of duties by the Audit and Supervisory Committee) and the policy for processing expenses or debts incurred in the execution of such duties

If an Audit and Supervisory Committee Member requests advance payment or reimbursement of expenses incurred in the performance of their duties, the Company will comply with such request, except when it is deemed not necessary for the performance of the Audit and Supervisory Committee's duties.

Other systems to ensure that audits by the Audit and Supervisory Committee are carried out effectively

In response to requests from the Audit and Supervisory Committee, the Company will disclose important documents such as approval documents, and will investigate, report and explain the duties of directors and employees. In addition, the Company will provide opportunities for the exchange of opinions with the accounting auditor.

Other matters

Requirements for resolution for appointment of Board of Directors

The Articles of Incorporation stipulate that resolutions for the appointment of Directors shall be made by a majority vote in the presence of shareholders holding at least one-third of the voting rights of shareholders who can exercise their voting rights. Additionally, the articles of incorporation stipulate that resolutions for the election of directors shall not be based on cumulative voting.

Items that allow matters to be resolved at a General meeting of shareholders to be resolved at a Board of Directors meeting

Acquisition of own shares

In order to enable the execution of flexible capital policies in response to changes in the business envrionment, the Company acquires its own shares through market transactions, etc. by resolution of the Board of Directors pursuant to the provisions of Article 165, Paragraph 2 of the Companies Act. The articles of incorporation stipulate that this can be done.

Interim dividend

In order to flexibly distribute profits to shareholders, the Company shall, by resolution of Board of Director Meeting, make distributions to shareholders or registered stock pledgees listed or recorded in the final shareholder register as of September 30th of each year, pursuant to the Companies Act. The articles of incorporation stipulate that the company may make dividends from surplus (interim dividends) as stipulated in Article 454, Paragraph 5.

Special resolution requirements for General meeting of shareholders

Regarding special resolutions at General meetings of shareholders pursuant to the provisions of Article 309, Paragraph 2 of the Companies Act, the Company shall ensure that shareholders holding at least one-third of the voting rights of shareholders who are eligible to exercise their voting rights are present and that their voting rights are The articles of incorporation stipulate that a two-thirds or more vote is required. The purpose of this is to ensure that general shareholders' meetings run smoothly by relaxing the quorum required for special resolutions at general shareholders' meetings.

Limited liability contract

Pursuant to the provisions of the Articles of Incorporation, the Company has individually concluded agreements with all Outside Directors and Directors who are Audit and Supervisory Committee Members that limit their liability for damages under Article 423, Paragraph 1 of the Companies Act. The limit on liability for damages under these agreements is the minimum amount stipulated by law.

Directors Liability Insurance Contract

We have concluded Directors' Liability Insurance contracts with insurance companies, pursuant to Article 430-3, Paragraph 1 of the Companies Act, with our directors as insured. This insurance contract provides for compensation for damages and litigation costs up to a maximum of 2 billion yen in the event that the insured is liable for damages in connection with the performance of his/her duties, and the Company bears the full insurance premiums. The contract with the insurance company also provides for the exclusion of compensation for damages incurred by the insured arising from the insured's improper performance of his/her duties, such as claims for damages arising from the insured's illegal acceptance of personal benefits or conveniences, claims for damages arising from the insured's criminal acts, and claims for damages arising from decisions or actions made by the insured beyond the authority granted by the company, thereby preventing the insured from impairing the appropriateness of the performance of his/her duties.

Promoting and enhancing dialogue with shareholders

In addition to appropriately providing necessary and useful information for shareholders to properly exercise their voting rights, the Company strives to engage constructively with shareholders by holding financial results briefings and regularly conducting shareholder surveys. We strive to promote and enhance dialogue. We have established an appropriate system for dialogue with shareholders, such as reporting the opinions of shareholders ascertained through these dialogues to the Board of Directors and other relevant officers and departments.